The past few years have seen a steep rise in digital payment systems. Thanks to digital transformation, mobile wallet apps dominate the online payment market and are increasingly preferred for quick and fuss-free transactions. Also, it’s an easy way to get rid of the waiting time to pay bills or transfer money.

Following the popularity of digital wallet apps, many startups have built their payment platforms in response to this growing demand. The success stories of Apple Pay or PayPal are an inspiration for several mobile wallet app development companies and entrepreneurs.

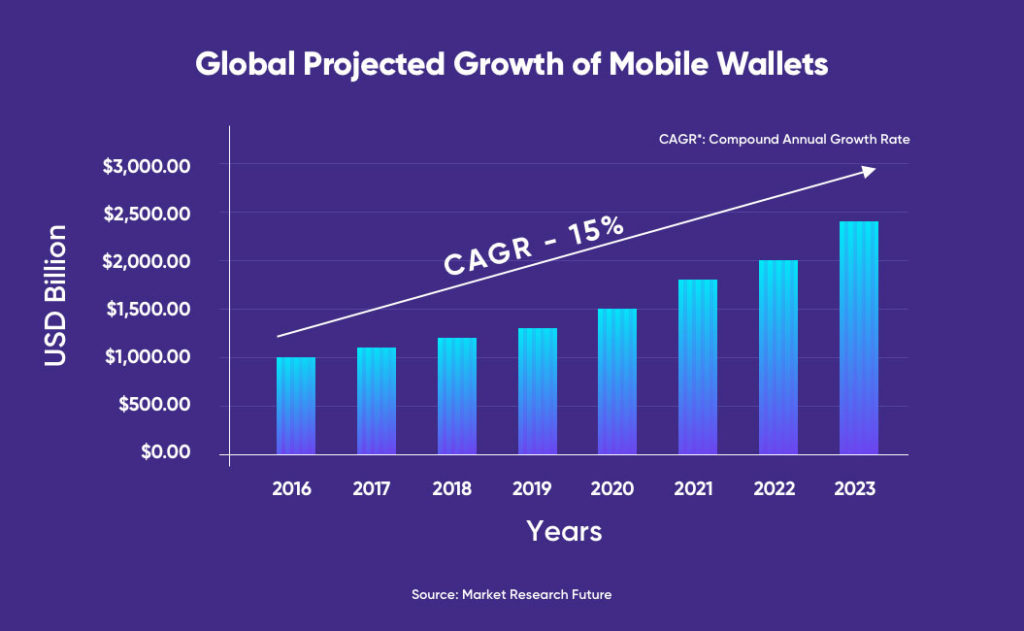

The Global Forecast Report shared by Market Research Future estimates that the e-wallet market will rise at a CAGR of 15% and is expected to reach around $2100 billion by 2023.

We respect your privacy. Your information is safe.

What is a Mobile Wallet App and How Does it Work?

A mobile wallet is an advanced rendition of a physical wallet, where one can keep the money to buy different services and products. One can use this digital wallet on a mobile phone by simply downloading the application and entering essential information like name, credit or debit card information, etc.

A mobile wallet can efficiently replace debit or credit cards and cash by simply allowing customers to pay anywhere with a single tap.

These kinds of wallets offer customers the convenience of buying products online and transferring money instantly.

Mobile wallets work by utilizing NFC (Near-Field Communications) empowered technology or QR technology. They store the customer’s payment information in an encoded format for security reasons. Some of the best digital wallet apps also let customers purchase goods within the app by offering coupons, discounts, and other loyalty cards or programs to keep users hooked.

A digital wallet works by communicating with terminals using different kinds of information transfer technology. However, most mobile wallets utilize NFC technology to serve the purpose.

Why are Mobile Wallet Apps Popular?

The mobile wallet app offers a secure and reliable payment solution and ensures that the transaction happens quickly. Mobile wallets let you send cash from your smartphone, either to another person or to a payment terminal at the click of a button, making your transaction quick and simple.

The market is expected to grow at an annual rate of 33% from 2019 to 2026, reaching $457.4 billion in 2026. – SBWire

It is also important to launch a market research campaign to gain information about competitors, users, and application functions to improve the app performance for the end-users.

How to Build a Mobile Wallet App?

A mobile wallet application is a fine collection of various features and functions aiming to ease the payment process for customers. To build a successful digital wallet app, you need to make sure that you integrate and implement all the desired and required features in your app.

Do thorough research of the market where you want to launch this app and determine your customers’ expectations before indulging in the development.

One of the most important aspects of a mobile wallet app is its security. These apps require saving the very confidential payment information of customers. Therefore, it is your first responsibility to make sure that you keep this information secure using advanced technologies that are impossible to decrypt.

To create a mobile wallet app successfully, consider hiring an experienced mobile app development company to help you en-route efficiently. Let’s now see some of the features that can help you make your mobile wallet app standout in the market:

7 Key Features to Include in Mobile Wallet Apps

Here are some factors to consider while developing the best mobile wallet app for your business:

1. Ease of Use & Seamless Transaction

Processing a payment through a mobile wallet is quick and smooth. All you have to do is link your debit/credit card and a valid document with the e-wallet apps. It saves your information for authentication and offers a secure and seamless transaction anywhere and anytime in the world. Users can also synchronize their data with multiple devices to use the e-wallet on several gadgets.

2. An Interactive and Smooth UI/UX Design

UI/UX design plays a vital role in user engagement. An attractive mobile wallet design can appeal to the user and encourage interaction and popularity. To ensure the app is user-friendly and easy to use, one must consider mobile UI/UX design as a crucial part of app development. It helps in better engagement and readability of your app for the users.

3. Cloud-based Technology

With this feature, quick transactions are possible in a secure manner. The cloud-based technology gives customers the full suite of capabilities to transform their smartphones into digital wallets. For instance, a payment made with a simple tap at Point of Sale (POS) terminals is easing the payment process for vendors, issuers, and buyers alike.

4. GPS Tracking & Navigation

Nowadays, e-wallet functionality allows any person or business to accept mobile payments no matter where they are. Thanks to geolocation, GPS tracking & navigation is one of the essential in-built features of the e-wallet app.

With the help of GPS, users can locate people on their devices and make the payment with just a tap on the specific user name. The feature helps save time as no account information is required, and the transaction is done efficiently.

5. Wearable Device Integration

Wearable technology is not just limited to fitness trackers, smartwatches, or smart jewelry, but is also the next logical step for mobile payments. As per Tractica, wearable payments will grow to about $500 billion by this year 2020, from $3 billion in 2015.

Just like contactless debit/credit cards, wearable payment gadgets contain a Near Field Communication (NFC) chip. This chip contacts the chip in the card reader at the point of sale, enabling a convenient transaction.

6. Spending Analysis

Spending analysis is an additional tool that you must incorporate into your mobile wallet app to enable users to examine their spending. It encourages users to plan their spending better and limit their expenditure wherever needed.

7. Privacy & Security

An e-wallet expects users to store their card information and enter their passwords. So, one of the most important features of e-wallets is to store this data securely. As wallet apps are always a soft target for hackers, mobile wallet app developers must develop a password-protected app with features like fingerprint, OTP, and QR code for proper authentication and validation in addition to a secure, fast, and efficient payment transfer.

Examples of Popular Mobile Wallet Apps

Here are a few mobile wallet apps that offer a seamless experience to their customers.

Amazon Pay

Amazon Pay is an online payment processing service that Amazon owns. Established internationally in 2007, it gives users an option to pay with their Amazon accounts on external dealer sites. Amazon Pay is considered one of the most popular e-wallet apps that also allows quick and convenient shopping at the tap of a finger.

Google Pay

Google Pay, a part of the Google ecosystem, has scaled up its customer base very quickly as compared to other mobile wallet apps. With Google Pay, one can transfer money to friends/family, pay bills, purchase online, and so on. This Google wallet app works securely with your existing bank account. The KYC (Know Your Customer) formalities aren’t mandatory here, and you can entirely rely on this ewallet for securely transferring money.

PayPal

PayPal is known as the granddaddy of online payment companies with a history since 1998. It is one of the best mobile wallet platforms when it comes to shopping online. It’s the only mobile wallet app that you can use to send and get cash from any US-based financial or bank account as well as transfer money to family or friends without any fees or deductions.

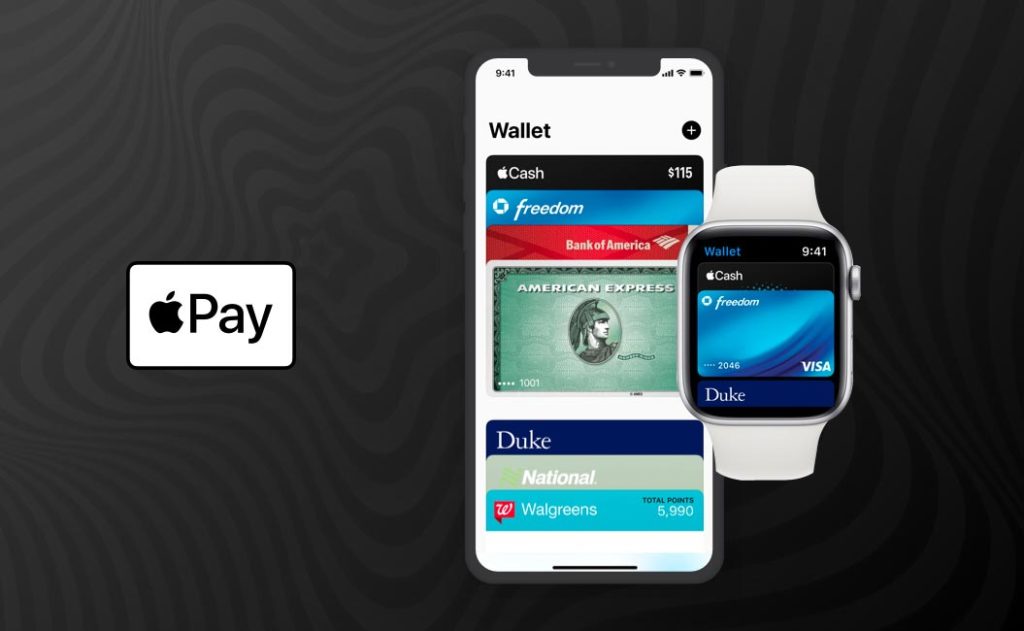

Apple Pay

Apple Pay is a contactless payment method developed by Apple Inc. for its users. It was intended to move users from actual wallets into a reality where they can use their credit or debit cards on their iPhone or Apple Watch, permitting them to pay using an Apple device instead of cards. It is accepted by millions of stores and restaurants worldwide. As per reports, over 75% of retailers in the USA and over 85% of retailers in the UK support Apple Pay.

Final Thoughts

The key features mentioned above in this article stress the importance of building a customer-centric mobile wallet app that makes transactions easy and quick. Being used widely for electronic invoices, account security, and error-free transactions, mobile wallets are increasingly becoming the most sought-after feature by businesses and customers alike.