For every business involved in online credit card payment processing, being PCI Compliant is a part of following industry best practices. This applies to eCommerce merchants, payment processors, and service providers. Being PCI compliant implies that all credit card payments are stored, processed, and transmitted safely and securely.

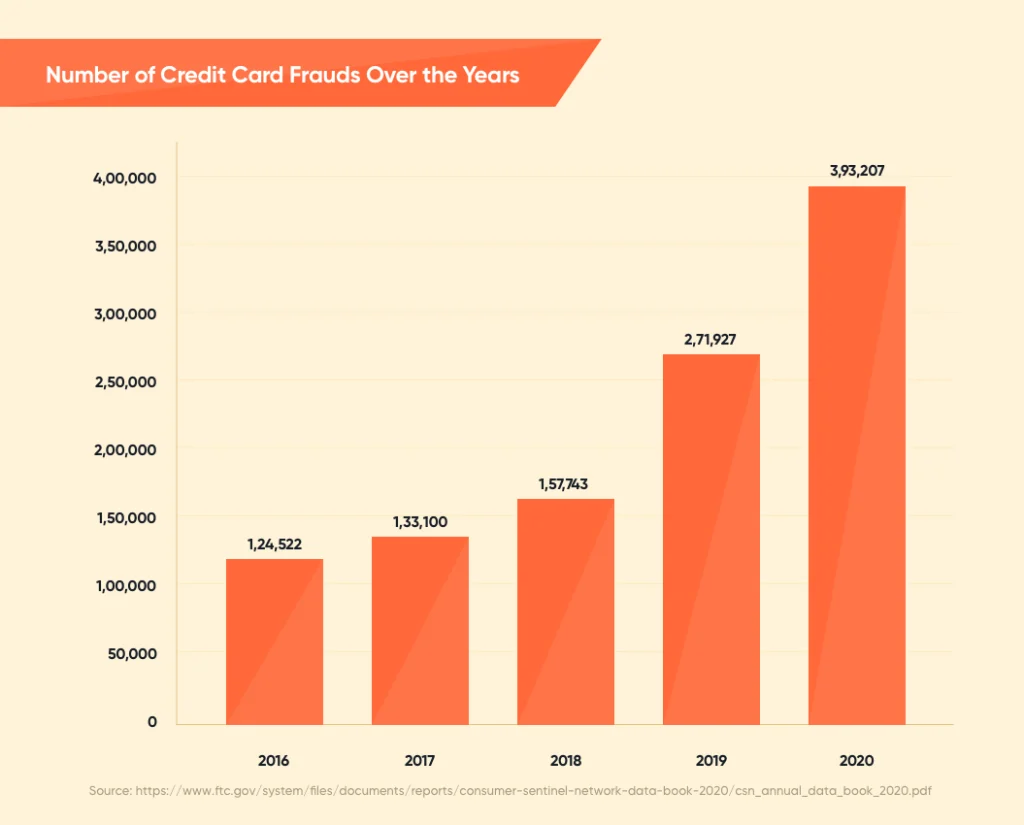

With the increasing credit card frauds across the globe, ecommerce web development services have begun to increasingly prioritize building secure systems.

PCI compliance is an assurance that you are a trusted service provider for credit card payments. You can call PCI compliance as proof of secure payments across the payment gateways.

The following section captures everything about PCI compliance in detail.

What is PCI DSS Compliance?

PCI stands for Payment Card Industry and is a set of standards that any company dealing with credit card transactions should follow. The precise term is PCI DSS, which stands for Payment Card Industry Data Security Standard.

Credit card companies introduced the PCI DSS standard to ensure that all the credit card payments across the online platform are safe and secure. Being PCI compliant is profitable as it reduces the risk of data breaches and frauds and helps establish a brand reputation.

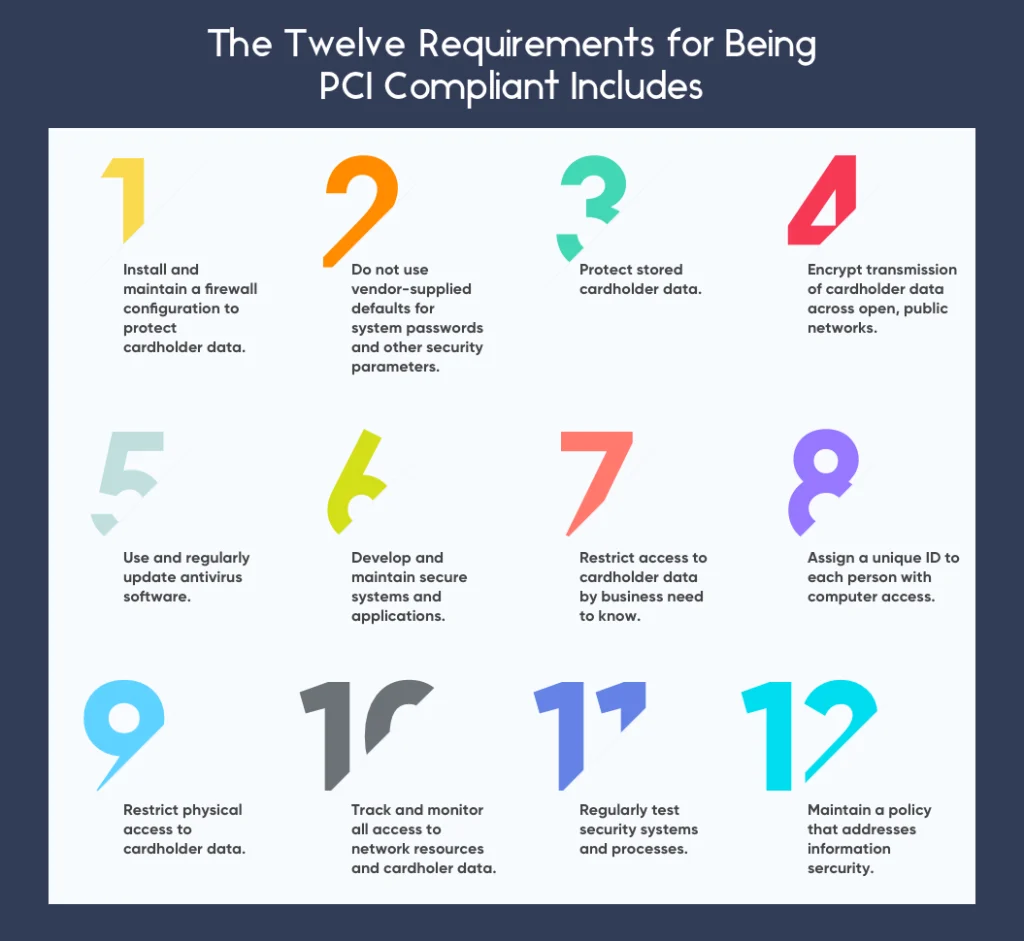

The twelve requirements for being PCI compliant includes:

Who is Subject to PCI Compliance?

PCI compliance is relevant for service providers and merchants who process, transmit and store cardholder data.

- Service Providers

A service provider business takes care of the credit card transactions on behalf of another business. They store, process, transmit the card transactions, ensure the data’s safety, and protect it from any fraud.

- Merchants

A merchant is an eCommerce business or any other product vendor that accepts credit card payments directly for items and services sold online from their online platform.

The Four PCI Compliance Levels

The four PCI levels include:

| Level | Transactions Covered |

|---|---|

| Level 1 | More than 6 million transactions per year |

| Level 2 | 1-6 million transactions per year |

| Level 3 | 20,000 – 1 million transactions per year for an eCommerce business |

| Level 4 |

|

Benefits of PCI Compliance for Merchants

Being PCI compliant saves you from:

- Monthly Penalties: Credit card companies are liable to impose a fine on you in case of missing PCI compliance

- Risk of data breaches: Being PCI compliant does not eliminate the risk of data breaches but reduces it greatly as you follow all the standards and requirements for maintaining a secure network

- Bad brand reputation: If the customer’s data gets breached, they will not trust with the payments again, and you are likely to lose them to a competitor with PCI compliance

- Loss of revenues: Bad reputation and revenues are directly connected. When customers do not trust you anymore, it is unlikely for them to trust you again

PCI compliance for eCommerce and Software Development

PCI compliance is beneficial for eCommerce merchants and product companies. The following section covers the relevance of PCI DSS for both sectors:

- eCommerce Platform Development

An eCommerce platform is a software product that allows an eCommerce business to manage its operations, eCommerce website and app, and marketing processes. Some examples of eCommerce solutions are Shopify, Magento, BigCommerce, etc.

These third-party providers also store, manage, process, and transmit credit card holders’ data across the payment gateways.

The upshot — all eCommerce platforms and eCommerce platform developers require to be PCI Compliant.

While outsourcing eCommerce platform development, make sure to ask whether the platform is PCI DSS certified or not. The best eCommerce platforms support — integrated payment gateways that help you transmit customer credit card information using direct post API methods.

When the platform helps you integrate a safe and secure payment gateway, it becomes easier to apply and achieve PCI DSS certification for your business.

Here’s the process that an eCommerce platform developer follows to ensure that they stick to the PCI-DSS requirements:

- Offers the ability to build integrated payment gateways that allow secure payments through direct post API methods

- The direct post API method ensures that the cardholder data is directly transmitted to the payment gateway and does not reside on the application server. In other words, no sensitive data is stored on the application server

- Hosted payment forms (provided by payment gateway providers) are integrated into the checkout pages, helping in facilitating a seamless checkout process

- Software Development

The software development process that involves integrating a secure payment gateway, such as in the case of a SaaS product — having PCI compliance is a safe step forward.

PCI compliance requirement 6.3 focuses on building a secure payment solution as a part of the software development lifecycle (SDLC) process.

According to PCI compliance requirement 6.3:

a. Develop Application that Focuses on PCI Compliance Standards

This criterion involves:

- Enabling of secure authentication and logging

- Masking of cardholder data

- Enabling encryption

- Activating secure transmissions

b. Follow PCI DSS Best Practices

This criterion involves:

- Maintaining an ongoing security audit throughout the development process

- Identify the vulnerabilities early on and build a robust security framework

- Keep track of and avoid OWASP that lists down the top ten web application security risks

- Keep track of and avoid CWE 25 that lists down 25 weaknesses that can lead to serious security threats in software

c. Maintain Information Security Across the SDLC Process

This criterion involves:

- The requirements phase should cover the eCommerce security requirements, i.e., the PCI DSS requirements and the related best practices

- Ensure that the security requirements mentioned in the “Requirements” phase are a part of the design

- Ensure that the developers are trained to build secure codes and follow the best coding practices to defend the application against payment risks and errors

- Test the application to ensure it carries out safe credit card transactions, and all the security requirements are appropriately met

- Ensure that the DevOps team does not go into the production phase until it fulfills all the security requirements

- When the product life ends — all the credit card data related to customers should be securely deleted from the system

Why does Your Service Provider Need to be PCI Compliant?

When outsourcing software development or eCommerce development projects that require payment integrations, choosing a PCI-compliant agency is a good practice. This helps in:

- Ensuring that the payment gateway is built in adherence to the PCI DSS requirements

- It helps achieve your PCI compliance certification as the payment system is built using robust security measures

Questions to Ask your PCI DSS Compliant Outsourcing Partner

By choosing an outsourcing partner that already has a PCI certification, you ensure that the payment system of your software product or eCommerce platform is built safely. This, in turn, makes it easier for you to apply and achieve PCI certification for your business.

This is the reason why choosing a PCI DSS compliant outsourcing partner is a safe bet. And, when evaluating different vendors, make sure to ask the right payment security-related questions to make an informed decision.

Here are some questions that you should be asking:

- Does the payment gateway support secure capture and transmission of cardholder data?

- Does the business agreement between us mention the requirements and assurance of following PCI DSS best practices?

- Will the product/platform protect the payment-related data with encryption?

- How do you ensure that the development product/platform is in compliance with PCI DSS requirements?

- Will you provide security patches and updates after the product/platform is deployed to the live environment?

- Do you use multi-factor authentication when requiring remote access?

- In case of any data breach, do you provide support?

Is Net Solutions PCI Compliant?

Net Solutions is a PCI DSS Level 1 certified service provider.

This is the highest level of certification for a service provider. This achievement underlines Net Solutions continued commitment to its customers’ data and security.

Conclusion

Online credit card payments need to be safe and secure for your customers to trust you with their money. Being PCI compliant is a step forward towards ensuring payment security while gaining trust and reputation in return.

If you are outsourcing a software development project or an eCommerce platform — choosing a PCI compliant partner is a smart decision. The development agency will follow the PCI DSS standards and ensure to abide by all the underlying requirements. This, in turn, will help you easily apply and achieve your PCI compliance certificate.

SHARE THIS POST

Table of Contents

Related Services

Related Resources

- eCommerce App Development Cost: Budgeting In-Depth Guide

- 13 Differences Between B2B and B2C eCommerce Websites

- Top 10 eCommerce Challenges and Easy Ways to Overcome Them

- 3 Types of eCommerce Business Models That Work in 2024

- eCommerce for Business: Is eCommerce Applicable for All Business Types

- eCommerce Customer Journey Mapping - The Secret to Higher Conversion Rates

- What is Headless Commerce? The Ultimate Guide

- Top 15 eCommerce KPIs to Track the Performance of Your Online Business

- What is Adobe Commerce (Magento)? Everything You Need to Know in 2024

- Why Your Business Needs a Mobile eCommerce App

- Omnichannel Retail Strategy: A Comprehensive Guide

- Omnichannel vs Multichannel Retailing: The Complete Guide

- What is eCommerce Order Fulfilment? (And 6 Steps to Improve the Process)

- The BEST Guide to eCommerce Personalization

- 12 Essential Factors for Choosing the Best eCommerce Platform

- The Ultimate Guide to Product Information Management (PIM) Systems for Ecommerce

- What is a Product Recommendation Engine (And How it Helps Boost Sales)

- eCommerce Replatforming: Challenges, Benefits, and Best Practices

- The Ultimate Guide to eCommerce Security

- Top 13 eCommerce Trends in 2024

- How Voice Search will Transform the Future of eCommerce

- What is Web Accessibility (And Why it Matters for Your eCommerce Business)